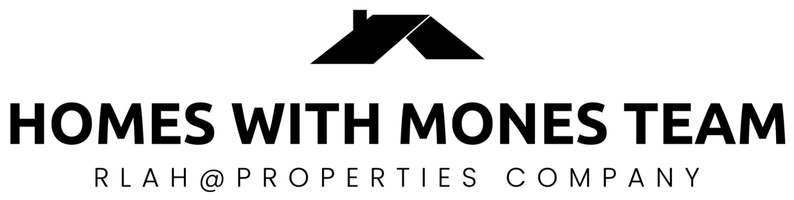

The 3 Steps Most Buyers Skip When Buying a Home

In this 8-part series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that is the right fit for your lifestyle, needs and, most importantly, your budget. It takes you through every single step and shows you how to avoid buyer’s remorse. Your first home is most likely the stepping stone for your next home so you want to do it right and set yourself up financially to move up to your next home. There’s a very specific formula and step-by-step approach that buyers – like you — should take to make sure they end up with the home that best fits their needs and budget. It requires some initial patience on your part so that each step is done right (and then you are prepared to quickly put in an offer with confidence when you reach that point!). Don’t Skip These Three Steps No one should rush out to purchase a home before they are ready since this is a big financial decision. Remember that slow and steady gets the “prize”! First, you should have determine your deal breakers, “must haves” and lifestyle goals. That process was covered in a previous article from this series —12 Questions to Answer Before You Step Foot in an Open House. Go back and read it again, and then you can move forward once you’ve answered the 12 questions. Now you’re ready for the next three important steps. But do not bypass these steps since you’ll end up wasting time, getting confused and, ultimately, buying a home that you will regret. Be 100% sure you want to be a homeowner Many people start looking for a home before they are truly convinced that buying a home is right for them. (Maybe their friends are doing it, they’re getting older, they’ve rented forever, etc). They think that by just looking at homes, it will help them make that decision for them. However, this is a sure recipe for making a big mistake! You must first make the decision that you want to make the commitment to being a homeowner. Buying a home is a big deal and a commitment that you have to be willing to make for at least three to five years, if not more. Before you go any further, you must decide whether this step in life is something you want to make and then commit to the process of looking for the perfect home, no matter how long that takes. Depending on the current market, the looking process can be frustrating, difficult, and hard to see through to the goal of becoming a homeowner. Don’t set yourself up to fail by thinking that if you found the right home, then you’ll become a homeowner if you buy it. Instead, make the conscious decision that buying a home is the right move for you right now—both financially and otherwise—first and foremost. Then you’ll be more committed to go down the (long!) road to becoming a homeowner and not look back. Slow down to get the best fit for you Often times, we spend so much time thinking about wanting to buy a home that once we make the decision to buy, we want to find a home ASAP. This is called immediate gratification syndrome. Don’t let it get the best of you! It’s understandable that you’ve been waiting all your life to have enough money, to be settled in your job and life in order to buy your first home. But you can’t just wake up one day and go buy the first home you see. It’s truly a process … and you want to make sure you are making the best decision for both your financial life AND for the life you want to live over the next few years. Figuring all that out and having a home that fits your goals does take time. Buying a home is like finding a mate and just because you decide you are ready to commit doesn’t mean you should marry the first person you go on a date with. Same thing with buying a home — once you’ve decided buying a home is the commitment you want to make, slow down to find just the right home for the life you want to create. That takes time…. Take a deep breath, slow down and understand the process; you might just enjoy it more and you will find that perfect home! Decide who will represent you There is a lot more than meets the eye to buying a home. You need someone experienced in the type of home you are buying—price range, location, and loan programs you’ll be best suited for. Not every agent knows how to help every buyer. Start with getting recommendations from friends and family. Think about where they bought and their price range. Only ask people in your life who would be buying something similar. Ask them what they liked and didn’t like about the agent they worked with. Once you have a list, reach out to at least two to three agents and ask them how they work and where they have sold homes recently and in what price range. Then set up an appointment to meet them for an initial consultation. You don’t need to know everything about the home-buying process before you meet, they should be educating you about the process and what you need to know to make your first purchase successful. Some internet research on your own is just fine, but your agent will get you up to speed on the current real estate market, provide insight on local neighborhoods, and also advise you on mortgage options and home-buying assistance programs for first-time buyers. Be honest with your agent and soon you’ll get a sense if you and your agent will be compatible and well-suited together. It’s important to have a good working relationship and be attuned to each other. That way, your agent will “get” you and be able to also anticipate your likes, dislikes, and needs in a home even better than you may at this point! This is important since you want your agent to guide you toward homes that will work best for you, and your wants, needs, and budget … and not waste time on homes that do not. And, finally, make sure you want to spend hours in the car with them every weekend 🙂 Congrats, you did not skip these important three steps! Now you can move forward. It’s time to figure out how to pay for your new home! Hope you are enjoying this series — How to Find the Perfect Home for You and Your Budget – and look out for next week’s article. You’ll learn the best way to budget for and finance your first home purchase.

Read More

Are You a "House" or a "Location" Person?

In this 8-part series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that is the right fit for your lifestyle, needs and, most importantly, your budget. It takes you through every single step and shows you how to avoid buyer’s remorse. Your first home is most likely the steppingstone for your next home so you want to do it right and set yourself up financially to move up to your next home. When you’re thinking about buying a home, what pops up in your mind? Are you most excited about living near your favorite coffee shop, certain restaurants or a convenient bike trail? Or are you filled with the anticipation of having a home with awesome features, like a chef’s kitchen, deluxe master suite, or a large yard with a patio? Usually people tend to lean toward one or the other — being a “house person” or “location person.” Which are you? It’s rare for any buyer to find their dream home in their dream location within their budget. That’s why you need to figure out what’s more important to YOU and where you’re willing to compromise. Some buyers want a larger house with lots of space for entertaining or for their family needs no matter what and are much more flexible about the actual location. Others hold true to the real estate creed of “location, location, location” and make the neighborhood and community their priority. As you can see, your answer will affect your daily life more than anything else. What Matters Most to You? It’s time for a little self-analysis. You should take the time to really understand your wants and needs before looking for a home (condo, townhome, or single-family house). Your honest answers are what will help guide your home search. This actually could be a “family” analysis – your spouse, partner or children should play a part in the decision-making. Make the three lists (below) – and use some of the brainstorming prompts to help get you going: 1) What are the characteristics you want in a location? How close do you want to be to your favorite things in life, whether that be a running trail or a coffee shop? How many things do you need to be able to walk to easily or be in your neighborhood? Do you need to be close to public transportation or not? What features of a location will have the most the impact on your daily routine? Are schools important? 2) What’s important about your home other than location? What are those features you dream about or feel like you lack now? How much space will you need in the next 5 years? What things do you really want on your list, such as yard space, office space, a garage, a master suite, or a gourmet kitchen, etc.? What about a favorite architectural style or type of home such as single-family, townhome, or condo? Does it have to be pet-friendly or at least have a nearby park or trail? 3) What is your absolute deal breaker(s) when it comes to a home or location? For example, street parking only, traffic/busy road, one-story home, not enough storage space for toys, long commute time, etc. Look over your lists and see what really stands out and makes you feel that it’s a “must” for you. Is it on the location list or the house list? This item should be something that you’re willing to make a priority in your search and will help dictate if you’re a house or location person. Remember, it also needs to be realistic. This entire analysis also should help you know what factors you’re willing to compromise on or do without in a home. Location, Location, Location Love If you’ve determined that “location” is your answer, then you know that “where you live” affects everything about your lifestyle (and you want that lifestyle no matter what!). You also have the attitude that you can always “change” the home to make it better suit you but you can’t change the location. This is an important factor when you consider resale and living in a neighborhood that will retain its value. Since location and neighborhood mean a lot to you, you’ll have to see what type of home you can purchase within your budget. Here are some options to keep in mind if your budget is tighter: Buy a smaller home, a fixer-upper, or one that lacks some features you’d like but don’t really need. Consider another home type. If single-family homes are too expensive, look at townhomes in the area. They can have similar inside space but are less costly. What about a condo unit? If you can’t find anything within your ideal area that fits your budget and most of your needs, then you might have to think outside the box. You don’t want to spend years waiting to buy or become a habitual renter. Here are some options: Be open to looking at other locations that have the same neighborhood “feel” you’re seeking but have less expensive homes. This can be an option when proximity to a job or school is not a factor. If proximity is a factor, consider looking at homes on the peripheral of the “perfect” neighborhood if homes are less expensive or have more of the features you would like in a home. Even though you may not be living right in the middle of this neighborhood, you may still be able to enjoy many of its nearby amenities. Homebody Rules If you’ve determined that “house” is your answer, you know that a home’s features are the key selling point for you rather than a specific location. Spending time at home, entertaining, and just enjoying your space will make you the most happy. Some buyers lean toward this answer since they would rather buy a move-in ready home and be flexible with its location in order to find one within their budget. Or, even if a certain location is tempting, these buyers know that renovating a home or purchasing one too small is out of the question for them. It’s actually easier when location is not too restricted in your search. Here are some options for you to consider: Once you know the home features you must have, then you’ll have an idea where you can buy within your budget. So your location search becomes flexible until you find the “right” home for you. It’s usually better to start with location and then focus on the home and budget, but the fact you are a “home person” doesn’t mean you don’t care where you live!! It means you’re more open to looking at different locations than eliminating features. Keep in mind that buying the biggest home on the block or buying the perfect home in a not-so-great neighborhood can be risky when it comes to retaining value and resale. You still want to make an educated decision when determining a location. With a little give and take you can find a home you’ll love in a location that can work for you and your family. If you have any questions about being a “house” or “location” person, please contact me. I have a list of questions that we’ll go through together. Your answers to those questions will provide great clarity to your search for a home and make sure you end up with the right house, in the right location, for the price you want to pay. In about 30 minutes, you’ll be headed in the right direction when it comes to your home search. Just know that you can have what you want in a home–location, size, and a price you are comfortable with. If you feel stuck, reach out and I’ll get you unstuck quickly. In next week’s article in my Find the Perfect Home for You and Your Budget series, you’ll be warned about the three steps most homebuyers skip, and you don’t want to be one of those buyers!

Read More

Questions to Answer Before You Step Foot in an Open House

In this series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that is the right fit for your lifestyle, needs and, most importantly, your budget. I’ll take you through every single step and show you how to avoid buyer’s remorse. Your first home is most likely the stepping stone for your next home so you want to do it right and set yourself up financially to move up to your next home. We all do it. We finally feel ready to buy a home, the time is right, we feel like we have saved enough for a down payment, AND we then assume the next logical step is to get online and find some open houses to go to. Resist that urge. Yep, we tell our clients to NOT start looking around at homes immediately! Why? Because I want clients like you to look “under your hood” so-to-speak and ask yourself some very important questions first. I want you first to define and picture the life you want to live and a home that will match it. Most agents don’t approach home buying this way, but I do. This “self-analysis” will dig deeper than “how much square footage would you like?” Your honest and revealing answers will lead you to the right home purchase — for you, for your lifestyle, and for your budget. Please don’t think that this brainstorming and self-exploration is something to scoff at … it is part of the process. It has worked for my past clients and it will for you! Your answers to the questions below will help you avoid a personal and financial disaster when it comes to real estate. You don’t want to rush in blindly when buying a home. That’s why if you slow down and take the time to think and really evaluate your life and the “what” and “why” for a home, the rest of your home-buying experience (especially the house-hunting part) will be that much more rewarding and stress-free. You’ll actually get everything you want … and maybe even things you didn’t think you could have (or didn’t think about before)! Questions to Ask Yourself Before You Step Foot in an Open House: 1.) How long do you plan to live in this next home (and also how long will you own this home if you plan on renting it out after you move out)? This is THE absolute most important question to answer honestly since it will affect the rest of your home-buying search. You must answer this question first before you continue to the others. 2.) What will your life look like during that timeframe? Answering this question will help you determine what purpose your home will serve, most specifically your wants and needs at that stage of your life. Plus, you’ll determine what your #1 driver (or reason) for buying a home now and for the time period you want to own that home. 3.) What about your current daily life do you love and are not willing to give up? For example, do you love being able to walk to work? Do you love going to your local coffee house every day and enjoy local conveniences? Do you like to go for runs outside or hit the gym instead? What is your actual reality day-to-day that you don’t want to sacrifice if you can? 4.) Are you more of a “homebody” or more of a “night-out-on-the-town” kind of person? Knowing the answer to this question will help you determine how much space you need. If you never have people over, then why have a huge space for that dining table you never use? But, if you rather cook dinner for friends than bar hop, then don’t give up your dream of having enough room to make this desire a reality. 5.) Do you work late and need to be close to the office with a quick, easy commute? This question will help you determine location as well as things like whether you need a dedicated parking spot. Or, maybe you love biking to work every morning, but don’t want to have your bike in your living room anymore. Then looking for bike storage in a building that’s easy to get in and out of every day, twice a day will be important to you. 6.) What are your personal and financial goals during the timeframe you are going to be living in this new home? For example, do you plan to change jobs at some point so that your finances may change – a possible increase or decrease in salary? You don’t want to have a mortgage that binds you to your current job, especially if your goal is to switch to a less stressful work life while living there. 7.) What are your hobbies and how will they impact your life while you live in this home? Confused? For example, would you prefer to live in a less expensive, possibly smaller home so you have the funds to travel the world or even for a favorite hobby … (think scuba diving, travel photography, etc.)? Or do you want to live close to an important outside interest (think horseback riding, sailing, ballroom dancing, etc.)? Or do you want space for your hobbies (think painting with canvases and easel, crafting supplies, or refurbishing antiquing finds, etc.)? 8.) Do you consider yourself a “location person” or a “house person”? SO important! Some people get more excited about the local amenities than the features inside their home. Usually, people tend to be more one than the other. Which are you? What do you tend to gravitate toward? For example, would you rather be near urban conveniences, lots of quiet green space, or a wider number of school choices? Then location could be more important to you. If so, many locations have distinct personalities, and you want to find one that works for you. Keep in mind that certain locations will feature only certain types of homes to buy – condo apartment, row house, townhome, or single-family home. On the other hand, if having lots of inside space, an awesome chef’s kitchen, and a Jacuzzi bathtub gets you all excited rather than any particular neighborhood, than you are more of a house person. 9.) Are schools in the neighborhood a factor for this home purchase? Even if you don’t plan to have children soon, it’s a question worth asking since homes in better school districts tend to appreciate more in value. If you have young children or plan to start a family in the near future, then getting yourself educated about schools will be important. Just remember that your agent can’t recommend school districts due to Fair Housing Laws. You’ll need to do your own research and get feedback from friends and family. 10.) What is there about your current home that you would like to change or be different in your next home? What bothers you every single day about your current home? For example, it could be the lack of closet space or not enough counter space in the kitchen. And, on the flip side, what is the absolute most important, can’t-live-without it, deal breaker thing you MUST have? (We all have one.) Do you really, really want that master bedroom suite or that large eat-in kitchen? What about parking space? Or to live near mass transit? 11.) Describe your ideal scenario when it comes to your home purchase and why. This is the time to dream BIG! After asking yourself all the questions above, now’s the time to take your brainstorming to pen and paper. Get out a piece of paper and write down everything you could possibly have if you could have it all (within reason) in your next perfect home. Don’t hold back! Write down things you might think are out of reach. 12.) What would you be willing to you compromise on in a home? It’s hard to start with what you are willing to give up, but after listing out all the things you DO want from the questions above (and don’t hold back on this part—list everything!) Circle three things you could possibly live without on that list. Congrats on answering all of these questions and hopefully it sparked some additional self-analysis that will help you find that perfect home! Next week, I’ll take a closer look at whether you are a “location” person or a “house” person. It’s your leading compass on where and what you will look at when you start house hunting.

Read More

How to Find the Perfect Home for You and Your Budget Series

In this series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that is the right fit for your lifestyle, needs and, most importantly, your budget. I’ll take you through every single step and show you how to avoid buyer’s remorse. Your first home is most likely the stepping stone for your next home so you want to do it right and set yourself up financially to move up to your next home. We all do it. We finally feel ready to buy a home, the time is right, we feel like we have saved enough for a down payment, AND we then assume the next logical step is to get online and find some open houses to go to. Resist that urge. Yep, we tell our clients to NOT start looking around at homes immediately! Why? Because I want clients like you to look “under your hood” so-to-speak and ask yourself some very important questions first. I want you first to define and picture the life you want to live and a home that will match it. Most agents don’t approach home buying this way, but I do. This “self-analysis” will dig deeper than “how much square footage would you like?” Your honest and revealing answers will lead you to the right home purchase — for you, for your lifestyle, and for your budget. Please don’t think that this brainstorming and self-exploration is something to scoff at … it is part of the process. It has worked for my past clients and it will for you! Your answers to the questions below will help you avoid a personal and financial disaster when it comes to real estate. You don’t want to rush in blindly when buying a home. That’s why if you slow down and take the time to think and really evaluate your life and the “what” and “why” for a home, the rest of your home-buying experience (especially the house-hunting part) will be that much more rewarding and stress-free. You’ll actually get everything you want … and maybe even things you didn’t think you could have (or didn’t think about before)! Questions to Ask Yourself Before You Step Foot in an Open House: 1.) How long do you plan to live in this next home (and also how long will you own this home if you plan on renting it out after you move out)? This is THE absolute most important question to answer honestly since it will affect the rest of your home-buying search. You must answer this question first before you continue to the others. 2.) What will your life look like during that timeframe? Answering this question will help you determine what purpose your home will serve, most specifically your wants and needs at that stage of your life. Plus, you’ll determine what your #1 driver (or reason) for buying a home now and for the time period you want to own that home. 3.) What about your current daily life do you love and are not willing to give up? For example, do you love being able to walk to work? Do you love going to your local coffee house every day and enjoy local conveniences? Do you like to go for runs outside or hit the gym instead? What is your actual reality day-to-day that you don’t want to sacrifice if you can? 4.) Are you more of a “homebody” or more of a “night-out-on-the-town” kind of person? Knowing the answer to this question will help you determine how much space you need. If you never have people over, then why have a huge space for that dining table you never use? But, if you rather cook dinner for friends than bar hop, then don’t give up your dream of having enough room to make this desire a reality. 5.) Do you work late and need to be close to the office with a quick, easy commute? This question will help you determine location as well as things like whether you need a dedicated parking spot. Or, maybe you love biking to work every morning, but don’t want to have your bike in your living room anymore. Then looking for bike storage in a building that’s easy to get in and out of every day, twice a day will be important to you. 6.) What are your personal and financial goals during the timeframe you are going to be living in this new home? For example, do you plan to change jobs at some point so that your finances may change – a possible increase or decrease in salary? You don’t want to have a mortgage that binds you to your current job, especially if your goal is to switch to a less stressful work life while living there. 7.) What are your hobbies and how will they impact your life while you live in this home? Confused? For example, would you prefer to live in a less expensive, possibly smaller home so you have the funds to travel the world or even for a favorite hobby … (think scuba diving, travel photography, etc.)? Or do you want to live close to an important outside interest (think horseback riding, sailing, ballroom dancing, etc.)? Or do you want space for your hobbies (think painting with canvases and easel, crafting supplies, or refurbishing antiquing finds, etc.)? 8.) Do you consider yourself a “location person” or a “house person”? SO important! Some people get more excited about the local amenities than the features inside their home. Usually, people tend to be more one than the other. Which are you? What do you tend to gravitate toward? For example, would you rather be near urban conveniences, lots of quiet green space, or a wider number of school choices? Then location could be more important to you. If so, many locations have distinct personalities, and you want to find one that works for you. Keep in mind that certain locations will feature only certain types of homes to buy – condo apartment, row house, townhome, or single-family home. On the other hand, if having lots of inside space, an awesome chef’s kitchen, and a Jacuzzi bathtub gets you all excited rather than any particular neighborhood, than you are more of a house person. 9.) Are schools in the neighborhood a factor for this home purchase? Even if you don’t plan to have children soon, it’s a question worth asking since homes in better school districts tend to appreciate more in value. If you have young children or plan to start a family in the near future, then getting yourself educated about schools will be important. Just remember that your agent can’t recommend school districts due to Fair Housing Laws. You’ll need to do your own research and get feedback from friends and family. 10.) What is there about your current home that you would like to change or be different in your next home? What bothers you every single day about your current home? For example, it could be the lack of closet space or not enough counter space in the kitchen. And, on the flip side, what is the absolute most important, can’t-live-without it, deal breaker thing you MUST have? (We all have one.) Do you really, really want that master bedroom suite or that large eat-in kitchen? What about parking space? Or to live near mass transit? 11.) Describe your ideal scenario when it comes to your home purchase and why. This is the time to dream BIG! After asking yourself all the questions above, now’s the time to take your brainstorming to pen and paper. Get out a piece of paper and write down everything you could possibly have if you could have it all (within reason) in your next perfect home. Don’t hold back! Write down things you might think are out of reach. 12.) What would you be willing to you compromise on in a home? It’s hard to start with what you are willing to give up, but after listing out all the things you DO want from the questions above (and don’t hold back on this part—list everything!) Circle three things you could possibly live without on that list. Congrats on answering all of these questions and hopefully it sparked some additional self-analysis that will help you find that perfect home! Next week, I’ll take a closer look at whether you are a “location” person or a “house” person. It’s your leading compass on where and what you will look at when you start house hunting.

Read More

Categories

Recent Posts

REALTOR® Lic# SP200205008|5005063|0225251751

REALTOR® Lic# SP200205008|5005063|0225251751I am committed to helping you find your dream home, selling your property for the best possible price, and providing top-notch real estate services. I am dedicated to providing personalized attention and expert guidance to meet all of your real estate needs. Whether you are a first-time homebuyer or an experienced investor, I am here to help you navigate the complex and ever-changing real estate market. I pride myself on local knowledge, professionalism, and commitment to exceeding your expectations. Explore my website to learn more about the services I provide and the properties I have to offer. Contact me today to start your real estate journey

+1(202) 494-0110 lorin@homeswithmones.com1017 O St NW Washington, DC, 20001

https://homeswithmones.com