Make a Winning Offer Without Going Overboard

Love Buying a Home series – Week 8 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next few weeks! You’ve done it … you found the home you want to buy! Now you’re ready to make an offer and tackle some of the next steps that will make you a homeowner. First, it’s time to determine your offer price and the amount of your earnest money deposit to show you’re a serious buyer. You’ll need liquid funds for this deposit, so make sure you’re ready to write a check with your offer. You also need to get prepared for some negotiation tactics. DO NOT forget about your deal breakers and the maximum amount you’d be willing to offer for a home. (Remember, you have a “monthly” budget in mind!) Here are some smart tips on getting a home for a price you’re happy with in the end: Step 1 – Evaluate the home and determine an offer price. • We’ll work together by looking at the comps to see what the current value of the home is based on what’s sold most recently. From there, we’ll discuss a number of other factors, such as how long the home as been on the market, what the market is doing in general and what information I have from the seller’s agent about how many offers they are expecting. • Don’t just go with the asking price. A home’s asking price might be too high or too low, so we’ll do our own research to see what price makes most sense based on recent sales of similar homes. • Use comps of homes similar to yours in the neighborhood or building. We’ll calculate the difference between the asking prices and final sale prices to get a feel for market conditions. Also look at those final sales prices to get an average of the current market price for your type of home. • Closely compare the features of your home to the others that recently sold. We’ll determine if your home has any valued-added features that might make the price go up OR if it lacks something that would bring the price down. • Consider ALL variables. We’ll look into whether this home sat on the market for a while or has it just been listed and may sell quickly? Is it more of a buyers’ market or sellers’ in this particular neighborhood and for this type of property? It’s not always the same answer across the board for every home. Find out about competing bids since these will affect your own offer. I’m in communication with the seller’s agent to find out whether there will be multiple offers coming in, and based on that, then going above the asking price is most likely required. • Determine your walk-away price and stick to it. We’ll make a clear decision about what price you feel comfortable paying in a way that a will have you happy with the outcome of the seller’s decision, whether you win or lose. I won’t let you get swayed to go over budget … I have a no regrets policy! Step 2 -- Make an offer and be willing to negotiate. Keep your offer simple with little stipulations if possible. This makes it easier for the seller to accept your offer and can help seal the deal quickly. We’ll find the perfect balance between given the sellers what they want and protecting you and not having you give too much away. On the other hand, be flexible when taking into account any stipulations by the seller. If you can accommodate the seller, do so if possible. For example, they may want to rent back from you for a month until they can move out of the home. Be cordial and not critical of the home. Sellers can be sentimental and may select buyers for more personal reasons than just price. Use that to your advantage! Make your offer contingent upon the findings of a professional home inspection. You’ll want to be able to renegotiate or back out if major defects are found. NEVER skip this step! If we are going to be a multiple offer situation, I may suggest that you consider a pre-inspection, which allows for you to know the condition of the home without making it contingent on the inspection. Step 3 -- Show you are a serious buyer. • Include your approval letter and put up a reasonable amount for your earnest money deposit. You want to show the sellers you are serious and are capable financially to buy this home, that means at the very least having an approval letter from a reputable lender who has already checked your documents and run your credit. • Your earnest deposit should send an encouraging signal to the sellers. Depending on the situation, you’ll need to do a deposit of 1% to 5%. These funds are deposited at the time there is an agreement and makes sure that what each parties says they are going to do happens. The amount of your deposit will show the sellers you really want this home and are making a serious offer. • Make your BEST offer based on that particular home’s situation. Offers should vary on the circumstances: If the home just came on the market and already has multiple offers, you may need to go higher in price and/or have fewer contingencies. A seller is going to choose the best offer first and start negotiating with that offer, or pick one from the options and not negotiate at all. So, give it your best shot right out of the gate in these circumstances if you find yourself in this situation. If the home has been on the market for a time, you’ll need to write a completely different offer — one that is more favorable to you versus the seller. Always back up such offers with comparable to support a lower price. These are the same types of strategies we’ll use whenever you get to this step. I’m sharing this with you now just so you can become more knowledgeable and confident whenever that time comes. When you are ready to start talking about buying a home, just email me and I’ll take it from there, but always on your timeline, not mine. And, when it comes to the offer writing step, just know that the goal is to get you the home you want without going overboard. That is possible, even now. It takes a specific strategy that I’m looking forward to sharing with you. In the meantime, keep reading this 14-part Love Buying a Home series. You’ll learn what you need to do once you’re under contract to buy a home in Under Contract: Locking in Your Mortgage Rate and Getting a Home Appraisal. These two very important steps can affect your sale and the interest rate of your loan. Stay tuned!

Read More

It’s the Fun “House Hunting” Guide

Love Buying a Home series – Week 7 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next few weeks! House hunting can be overwhelming, time consuming, and yes, even exhausting some days. But there’s no reason it has to be that way if you follow some simple strategies that will streamline your search and make you “shop” productively. But before you can even start looking at homes, you need to go through several steps in the buying process. You’ll need to carefully consider your budget, location ideas, and the criteria (number of bedrooms, etc.) of your future home. This article will take you through all this prep work first – that way your house hunting experience can be fun once you get started! These search strategies also will help you make house hunting less stressful overall. And better yet, you’ll have the confidence and the ability to put in an offer and, ultimately, have a successful closing. You’ll then get a list of simple house hunting tips that every would-be buyer should keep in mind. First, Understand the Process Your first step is to become educated about the process of buying a home in this market. I want to hear from you a few months or more before you are ready to start looking at homes, just so we can talk about what you are thinking you want to do, what you should be prepared for and so I can educate you on what’s happening in today’s market that you should be aware of. It’s better not to rush the home buying process, so reach out around the time you find yourself being on the apps a few times a week. ;) Want to know who the best agent is for you? Believe it or not, it might not be me and I’ll be the first to tell you whether I can help you or if you should work with someone who might be better versed in what you are looking to do. In the meantime, check out How to Find the Very Best Buyer’s Agent from my Love Buying a Home series for more details on working with an agent. The answer isn’t always me! Next, Know Your Three “Buckets” You want to house hunt with a plan and a purpose, and that’s were these three “buckets” play a key role – budget, location, and criteria. This analogy of three buckets refers to where each and every factor you need to consider when house hunting fits into one of these three buckets. Each bucket doesn’t have to be equal in “weight” but the total weight combined of the three buckets must balance the scale they sit on. That’s your ultimate goal. It’s also important for you to understand the following two requirements before you start viewing homes: Know where you are with the specifics for each one of the three – budget, location, and criteria; and Know how each one can affect or influence the others in your search for a home. Undertaking this step and seeing how each is linked is essential! If you “pour” too much in one bucket, you’ll need to adjust another bucket, and so on. For example, if you need to lower your budget, then you might need to change the location if homes are more expensive in your first choice of location OR you might have to consider getting a smaller home (fewer criteria) if you want the location to stay the same with that new budget. As you can see, one adjustment leads to another adjustment! Looking at budget, location, and criteria in this way can help you find the alignment you are seeking, which can lead you to a home that is affordable, in a location that meets your needs, and that satisfies most of your wants. Let’s do a review of the three buckets: Budget -- How Much Can You Really Afford? One of the first steps before you house hunt is to get pre-approved for a mortgage by a lender. Being “pre-approved” carries more weight with sellers than being “pre-qualified.” Going through this process requires you to know your monthly budget and what you can afford to pay toward a mortgage. We emphasize monthly mortgage payments, first and foremost, before you move on to price range. Once you’re pre-approved, you’ll have narrowed down a price range you can afford. Then you can search for homes within your approved amount. (But remember, even if you are approved for more by a lender, stick to your own monthly budget requirements!) You can review this budget process in two previous articles from this series: Do the Math – A Mortgage You Can Afford and 5 Steps to Obtaining a Mortgage. Location – What Lifestyle Are You Looking For? Once you’ve got your budget done, it’s time to move on to location, location, location. Remember that the location of your home will affect everything about your lifestyle and day-to-day life – from whether it has urban conveniences or will mean a longer commute to work. So always keep that in mind. First figure out WHERE you want to live in the DMV — DC, MD, or VA? Which specific neighborhood or even another similar neighborhoods do you picture yourself living in? Think about the characteristics of a neighborhood and ask yourself why is that important to you since it could be replicated it in a similar, less expensive neighborhood. Don’t be hesitant to even look at another similar neighborhood that wasn’t originally on your radar. It could meet your wants and needs too! Really think about your daily life. Love walking to work and don’t want that to change? Then, that becomes a “must” and some of your criteria could change (size, condition, etc.). Then you know you are willing to buy a smaller, more affordable home if you must live in a neighborhood you absolutely love near work. There are certain factors in a location – both desirable and undesirable -- that you should consider when you look at a home for yourself and for resale value. Does the neighborhood have good schools? Is the home on a busy corner lot? Also, keep in mind that revitalizing neighborhoods can be on your list if "desirable" neighborhoods are out of your price range. An up-and-coming neighborhood could be a bargain if you time it right, but you do need to tread carefully. Once you narrow down a location, your budget will determine what type of home you can afford in that particular neighborhood – such as a detached home, townhome or condo unit. Not happy with the results? Then you will need to adjust your “buckets.” Decide whether it makes sense to change neighborhoods, tweak your budget a bit, or maybe rethink your list of “must haves.” Criteria – What Do You Want and Need in a Home? Your criteria are things like how big of a home, how many bedrooms or bathroom, storage space, condition, etc. Aspects about the home itself you require. It can include both needs and wants. You should have a written a list of your needs and wants in a home from when you first met with your agent. Now is the time to look over that list again carefully and REMEMBER these items!! It’s very easy to get sidetracked once you start looking at homes and forget what your deal breakers are in a home. This list will make your search much more efficient and keep you focused on what is important to you and your family in a home, in a location, or in a lifestyle that you picture yourself in every day. You might never find the “perfect” home but you must decide what you need and also want in your first home. Remember that your needs are different than your wants. You need two bathrooms but want a master bath and suite. You need three bedrooms but a fourth bedroom would be nice for guests. See the difference. It definitely can be hard to choose what you prefer more (location or three bedrooms) or what you’re willing to do without (large backyard or updated, renovated kitchen). That’s why you need to keep referring to your list of must-haves and deal breakers to stay focused. If you are having a hard time with this step, sometimes a good question to ask yourself is “how long do I plan on living in this home.” Sometimes that can help prioritize what you want in this home vs. what maybe can wait until a future move. Go back and review How Your Needs and Desires Lead to “Home Sweet Home” to get more details. Then, Put It All Together Now that you understand the three buckets – budget, location, and criteria – it’s time to put them all together. I’ve shown you a little bit of how you have to adjust each bucket at times in order to find a home. Let’s now go into a bit more detail. Depending on how long your plan to live in your new home, you should rank the three buckets from most to least important. Yes, they are all important, but what is YOUR #1? Once you know your #1 bucket, you can start house hunting since you have a specific goal in mind. But, if you get frustrated or stuck, then you might just need to fine-tune or loosen ONE (not all) of those buckets. That’s why it’s important to be flexible on some things and know your deal breakers. For example, if you want to live in a home for 5 years and location is your #1 bucket, you might have to make adjustments to your criteria in order to afford a home in that neighborhood. You might have to get a home that needs work so you don’t blow your budget. Or maybe you’ll need to buy a smaller home or condo. This above example shows how adjusting your criteria – going smaller or not move-in ready – enables you to stick with your location and budget. That one bucket was adjusted so that you could hold firm on the other two. This give and take in balancing or aligning the three buckets helps make your home search more methodical and organized. Most buyers have to make these adjustments while house hunting so don’t be disappointed if you do too. Do You Need to Adjust Type of Home? As you make adjustments to your buckets, you may have to change the type of home you initially thought you would buy. This is your criteria bucket and type of home – single detached home, townhome, condo -- is a big one for it! Once you’ve narrowed down a location and hold firm to that, you’ll have a better idea of what type of home you can afford in that particular neighborhood. If you have your mind set on a different type of home, then you might have to rethink location (consider one with similar characteristics but with more affordable homes). There are pros and cons to all types of home, and that is something you can discuss with your agent who can help you sort through the details of each. For example, a condo unit in a building can provide homeownership for less cost since you don’t have a yard. You’ll also benefit from some onsite amenities such as a pool or gym, maybe a doorman … but remember you will have to pay HOA fees. So you’ll need to factor in all costs. A townhome can give you a bit more privacy and independence compared to a condo but may cost more to purchase. In this type of home, you may be able to enjoy your small bit of yard. Plus, there is usually lower maintenance and cost than a detached, single-family home with the same interior space. A detached, single-family home will give you the most independence but can be costly since it can require more maintenance both inside and outside. Are you ready for that responsibility? If you see yourself living in a home for 5 years but not much more than that, buying a condo or townhome can be a stepping stone to a detached, single-family home. Again, discuss this with your agent and understand the outlook for your local market. Now You’re Ready -- House Hunting Basics Now that you’ve got your three buckets aligned (or know how to keep adjusting them), you are ready to actually go see homes. And, more importantly, will have the confidence to put in an offer when you see one! Here are basic tips for this part of the process: Stay Organized and Focused Each Time. Keep a record of all your research and handouts on the homes you visit. It’s very important to set up a system that works for you so you can easily refer back to homes that day or the next. Write down comments of your likes, dislikes and any other helpful, more detailed observations. Use a system that you know works for you, whether it’s on paper, in your Notes app or whatever. Do it as soon as you’re done or during a viewing. Did you get a positive first reaction walking in there? Did you enjoy the brightly-lit rooms? Did you smell odors from a nearby restaurant? Don’t forget to take lots of pictures or videos to help jolt your memory when a day of house hunting is done. You’ll be amazed that you start to forget what you’ve seen in certain homes: beautiful hardwood floors, amazing fireplace or a view of a dumpster. Take a picture of the front door/home number of each home first so you know the pictures/videos that follow belong to that home. If you do this, then you can easily go through your notes and pictures to compare costs, neighborhoods, and home features. This also helps you stay focused on your needs and wants. And if you do need to make an offer quickly, you’ll have more confidence in your decision since you have your research right in front of you. On the flip side, you’ll know what homes can be deleted from your list after you review your pictures and notes after a day of looking. Maybe a home was a “maybe” initially, but now that you have time to think again, you can move it to your “no” list. That way you’re all set for the next day of house hunting OR you’re ready to make an offer on a “yes” home. Create a Schedule That Works for You. Make sure your agent is aware of your time schedule and expectations. Do you like to look at one or two homes in a session? Four? Eight? Weekends or certain weeknights? Your agent can better serve you and any time constraints if you make these arrangements from the get-go. Your schedule also will be affected by your local market and if homes are moving quickly or not. You may need to up your pace so you don’t lose out on a potential home. Don’t Forget to Ask for Drive-Bys. Don’t spend time driving around a neighborhood without a purpose! If you like driving around by yourself looking at homes, ask for a list of drive-bys or homes on the market you can consider from the outside (and at different times of the day and night). If one appeals to you, then your agent can make an appointment to see the interior so you don’t just rely on Internet photos. Many times, the outside, the street, the neighborhood is a deal breaker so just move on down the list. Communicate With Your Agent (and Yourself). Honest communication is essential. Express your likes and dislikes after seeing a home. Don’t be afraid to tell your agent what you really think since they won’t take it personally … they don’t own the home! If you are more open with your agent, then they will know your personality better and can identify homes that will appeal to you. They will get a better sense of what you are looking for after each visit when you are honest with them. Never feel guilty or pressured! Even if you may see a home that is in pristine condition and move-in ready, don’t be afraid to say this isn’t the home for you if it doesn’t meet one of your “must-haves” for some reason. Or, you may be interested in a home that’s a major “fixer upper” or is being sold “as is,” which means the seller has no intention to do any repairs. Your agent can help you determine if you are ready to undertake such a project in order to become a homeowner. By following these smart house hunting strategies and knowing your three “buckets,” you will find your new home in no time (and maybe have some fun along the way)! Taking your house hunting seriously while having a lot of fun together is what it’s like to house hunt with me. Let’s work together to help you find the right home. Email me when you are ready and I’ll be with you every step of the way to give you out of the box strategies, help you find the best possible home for your budget and we’ll have a lot of fun along the way.

Read More

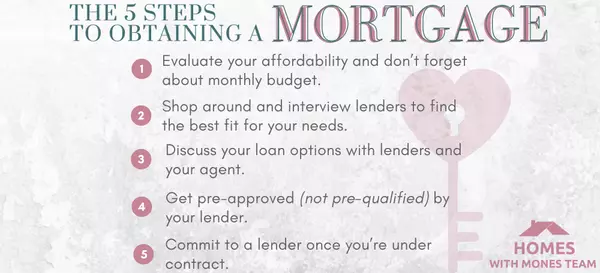

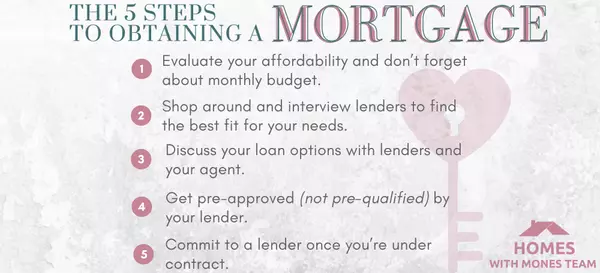

5 Steps to Obtaining a Mortgage

Love Buying a Home series – Week 6 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next few weeks! Today’s mortgages are not “one-size-fits-all.” That means you’ve got lots of options out there that could fit your budget and finances. This is good news for many home buyers! However, you do need to do your homework first so that your mortgage application can be processed properly and with success. The lending environment can be complex and complicated at times. Lenders, underwriters and mortgage insurers must all complete certain steps before they can have your financing in place. It’s important to try and keep things going smoothly by taking on a few steps of your own and knowing what needs to be done next. This preplanning will help get your mortgage and financing all figured out. That way you can avoid any snafus when you least want them to appear. Once your mortgage situation is all set, you’ll be in a much better position to negotiate with the sellers and move forward on a purchase. Here’s what you need to keep in mind: Evaluate your affordability and don’t forget about monthly budget. Do you truly know how much mortgage you can afford and how lenders determine it? Lenders and mortgage insurers look at a variety of factors, but the two most important are your monthly mortgage payment and your total debt load, relative to your gross income. You may hear a lender call this your “debt-to-income ratio.” But wait, let’s hit pause first and ask this question instead: How much are you actually comfortable spending on a mortgage payment each month? This is a much better way to determine your affordability. It’s important to emphasize knowing what your monthly budget is for housing, NOT just the purchase price that your lender will approve you for! Many of you will want your monthly housing expenses to be much lower than what a lender is willing to lend you. This topic was covered in detail in Do the Math – A Mortgage You Can Afford, the fourth article in this series. Go back and review if you need a refresher. This article makes you carefully look at your monthly budget, including current expenses and future ones as a homeowner. Shop around and interview lenders to find the best fit for your needs. Talk to several lenders at different sized banks. Rates and fees are typically very competitive between lenders, so it’s often more important to focus on other factors, including the level of service provided and how well they’ve executed transactions for other buyers. The type of mortgage you are seeking may also impact your choice of lender, since some are more familiar with certain mortgage programs than others. This is so important to understand, and lenders should understand that you will be shopping around. Different banks can offer different programs, especially in today’s market. Buyers could save over $200 a month on their mortgage payments just by talking with one lender that has a loan program that other banks may not offer! Discuss your loan options with lenders and your agent. Deciding what types of mortgage is best for you depends on your personal situation, your financial scenario, and your future plans. It’s something you’ll discuss during your lender interviews. For example, if your down payment isn’t large enough to qualify for a conventional loan, an FHA mortgage can be an excellent option. Alternately, you may qualify for an attractive first-time home buyer program offered by a local jurisdiction. Mortgage programs are always changing. You need to sit down with your lender to understand the different options out there that could work for you and the type of home you most likely will purchase. And don’t forget that your agent is a good resource who can help guide you on your decision. They know what has worked for other buyers who may have similar finances. Get pre-approved (not pre-qualified) by your lender. Plan to complete a loan application with one or more lenders. Make sure to take it one step further from getting pre-qualified and get pre-approved instead. By doing this you will know exactly what loan amount you will be approved for by the lender. (Remember, stick to your monthly budget no matter what you get approved for!) But this does give you the go ahead to look at homes in a certain price range. To start this process, you will need to supply information to the lender along with your application. So make sure you’ve gathered the required documents before you meet with them. To get pre-approved, the lenders will perform an extensive check on your financial background and credit rating. You will be notified in writing the amount they are willing to lend you for a home purchase. This process is an important step that will put you in a better negotiating position with sellers. Your pre-approval signifies to sellers that you are a committed buyer who has financing secured. When you make an offer, it won’t be contingent on obtaining a mortgage. Commit to a lender once you’re under contract. As soon as you are under a contract to purchase a home, you must “lock-in” and commit to working with one lender to complete your mortgage application. This needs to happen immediately upon going under contract to meet the deadlines you’ve agreed to in your offer. You will probably be charged a fee at this point because this is when the lender starts incurring processing expenses on your behalf. Show your lender that you are serious about working in partnership with them by submitting all the required documentation as quickly as possible. At this point they also will be “approving” your home and will await its appraisal to determine if they will lend you money. You want the appraisal to come in at or above the sales price. As you can see, there are certain steps you’ll need to take to get a mortgage. I can help you navigate through them. We want to meet to get the mortgage process out of the way well before you want to start looking at homes, so be in touch with me when you are ready. I’m here for you! Stay tuned for next week! The Fun House Hunting Guide is the next article in Love Buying a Home series. You’ll find out the ways you can shop productively (and smartly!) with tactics that will streamline your search.

Read More

Where to Find Money for Your Down Payment

Love Buying a Home Series – Week 5 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next few weeks! Coming up with a lump sum of money for a down payment can be scary and daunting to many first-time buyers. You definitely don’t want to wipe out your entire savings to purchase a home. It doesn’t have to be a roadblock to homeownership! Once you’ve got your monthly budget all set and know approximately how much home you can really afford (see the fourth article in this series), the next step is dealing with your down payment. Here’s some guidance on where you can find cash for your down payment and also a rundown of some great homebuyer assistance programs that can help reduce the amount taken out of your own pocket. How Much Down? How much money you need for a down payment can depend on the type of mortgage you will get for your financing. Lenders of conventional loans may require 3, 5, 10 or 20% down, depending on your credit and other factors affecting your financial picture. FHA loans can require as little as 3.5% down. If you are a veteran, you can put 0 down! However, the amount you put down really depends on YOU. If you’re a first-time buyer, don’t put all of your savings into your house. You may need some of that cash once you’re a homeowner. Instead, put down just enough to buy the house and get a monthly payment that works for your budget right now. These days, you don’t have to put 20% down to avoid paying monthly Private Mortgage Insurance (PMI). Monthly PMI is typically not tax deductible (check with your tax advisor since it depends on your situation), so most people want to avoid it. A smart strategy for first-time buyers -- who don’t have 20% down OR who don’t qualify for a first-time homebuyer program that helps get them to 20% down -- is to have your lender increase your interest rate just slightly. This small increase will hardly change your monthly payment but is enough to avoid the “risk” of PMI or the PMI becomes tax deductible. Once you narrow down your mortgage options and take into account any homebuyer assistance programs, you’ll have a better idea of how much you’ll actually need for your down payment. Next week you’ll learn to sort through all the mortgage options out there so stay tuned for that! Here’s a rundown of where to find money for your down payment: Help from Homebuyer Assistance Programs As a first-time homebuyer, you may qualify for many of the state and local assistance programs out there, many of which could help cover some of your down payment and/or closing costs. Plus, several lenders also offer grant programs that can also help with down payment and closing costs. If you’re a first-time buyer with a moderate income, you should look into these programs before you consider other options … it’s like free money toward your purchase! For instance, many assistance programs could be a good match for you and your circumstances. Definitely make it a priority if you’re a state, country or city employee since many local jurisdictions want to make it possible for you to work and live in the same community. I can give you a complete update of current programs out there for first-time buyers. Don’t hesitate to contact me. Should You Tap into Your Retirement Accounts? You may have a nest egg of cash that you thought was off limits! These options below may not be the best choice for you, but they are something to consider if funds are needed. Keep in mind, you will need to follow some set rules to access this money, and should always consult with an advisor to clearly understand any tax implications. Borrow From Your 401(k) Plan. Check with your employer to see if your 401(k) plan allows for loans. If you have less than $20,000 in the account, you can borrow the amount of your vested balance but no more than $10,000. (The maximum loan amount under the law is the lesser of one-half of your vested balance in the plan or $50,000.) Remember if you leave or lose your job, you may have to pay back the entire amount in 60 days or sooner. So be sure you understand any tax consequences, penalties and charges as well as repayment terms. Withdraw Funds From Your IRA. Usually, money in an IRA can't be withdrawn before age 59 ½ without incurring a 10% penalty. However, you have no worries about a penalty if you’re a first-time buyer or someone who hasn't owned a principal residence for two years prior to signing a binding sales contract. You can withdraw up to $10,000 penalty-free from an IRA for a down payment if you meet these requirements. If you and your spouse are both first-time buyers, each of you may pull from your retirement accounts, giving you a total of $20,000 in cash. Keep in mind, any withdrawals from a traditional IRA must be reported as income and taxes must be paid. This $10,000 is a lifetime limit -- and must be used within 120 days of receiving it. Withdraw Funds From Roth IRA. The rules are a bit different if your nest egg is in a Roth IRA. The $10,000 you take out for your first home is a qualified distribution as long as you've had your Roth account for five years. This means you can take out your retirement money without penalty, and because Roth earnings are tax-free, you'll have no IRS bill either. Reach Out to Friends and Family You might be reluctant to ask your family, but they can be a great source for your down payment. You will need to decide if this is a gift or a loan. Your parents might have done the same thing when they bought their first house! Gift from Family. Immediate family will often help with home purchases. Gifts up to $19,000 per year per person can be given without worrying about the gift tax. This means, for example, that every year your mother and father can give you and your spouse a total of $76,000 without having to file a gift tax return. Documentation is required so you need a letter stating that the money is indeed a gift with no expectation of repayment. Borrow from Family or Friends. You may prefer to ask for a loan rather than a gift from a loved one. However, your lender needs to know if you are borrowing from family or friends since they will consider this an additional debt for you. The lender will factor this additional debt into its own decision on whether to loan you money. Boost Your Savings This is one area where you have some control over and should start making an effort as soon as you even begin thinking about buying a home. The earlier you start, the more you can increase your personal savings. Tax Refund. Consider changing your withholding exemptions from 1 to zero. Your paycheck will be reduced but you’ll get a bigger check at tax time to use toward your down payment. That way you won’t use the money up during the year and will have a big chunk at the end. Deposit $$ in Bank Regularly. You’ve probably heard this before, but it does work: Get into the habit of putting the same amount of money into your savings after every paycheck. If you get paid every two weeks and save $200 from every paycheck, you will have saved more than $5,200 after 12 months. Not bad! Sell Stuff on eBay or Craigslist. Everyone has unwanted items that take up space. Consider selling these items and put that money toward your down payment. Getting a mortgage these days, especially for your first home, is definitely not “one-size-fits-all” these days. Email me so we can set up a time to talk through the options and narrow them down to which one or ones are best for you and your particular financial situation and goals. Next week get all the details in the Five Steps to Obtaining a Mortgage.

Read More

Categories

Recent Posts

REALTOR® Lic# SP200205008|5005063|0225251751

REALTOR® Lic# SP200205008|5005063|0225251751I am committed to helping you find your dream home, selling your property for the best possible price, and providing top-notch real estate services. I am dedicated to providing personalized attention and expert guidance to meet all of your real estate needs. Whether you are a first-time homebuyer or an experienced investor, I am here to help you navigate the complex and ever-changing real estate market. I pride myself on local knowledge, professionalism, and commitment to exceeding your expectations. Explore my website to learn more about the services I provide and the properties I have to offer. Contact me today to start your real estate journey

+1(202) 494-0110 lorin@homeswithmones.com1017 O St NW Washington, DC, 20001

https://homeswithmones.com