Love Buying a Home Series — A First-Timer’s Guide

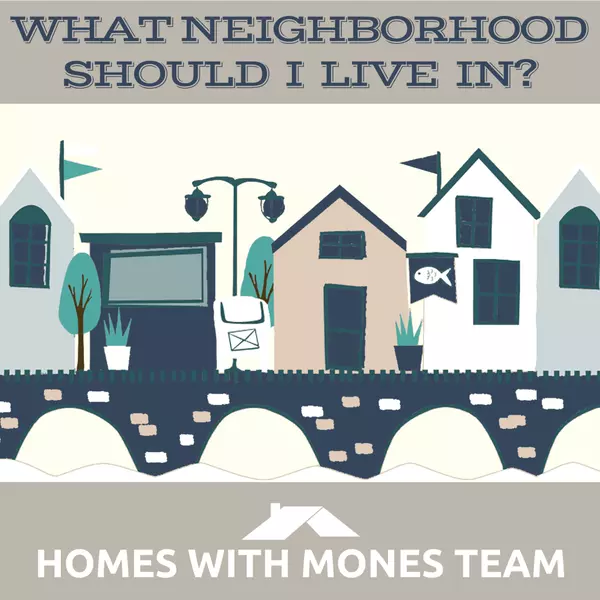

If you’ve been thinking about buying a home and are just not sure of the steps involved or even where to start, then this 14-part series is a MUST read for you. Each week, you’ll get great tips and easy-to-understand how to’s that will help you be successful in purchasing a home in today’s market. And, it’s all delivered to you in sequential order so you know what to do when … one bite-sized chunk at a time! I understand that this is all new for you and this series will help you avoid feeling overwhelmed and calm any fears you may have about “not knowing what you don’t know.” Week 1: A First-Timer’s Guide –An introduction to this Love Buying a Home series (what you’re reading right now!). It gives a breakdown of all the topics week-by-week. Keep on reading below for more information about this great series for first-time buyers. Week 2: How to Find the Very Best Buyer’s Agent — You want to choose a real estate agent who is the right person to represent YOU through the many steps in buying a home. Think about what’s important to you and what you are looking for in a home and then make sure your agent has experience that meets these specific needs and goals. Week 3: How Your Needs and Desires Lead to “Home Sweet Home” — You’ll get a breakdown of the honest questions no one else is asking you about your home search, and the exact questions you need to ask yourself BEFORE you start house hunting. This list goes way beyond how many bedrooms and baths you want. You’ll learn that this often overlooked step will determine everything that happens during your entire home-buying experience. Week 4: Do the Math — A Mortgage You Can Afford – Figure out how much home you REALLY can afford! You’ll get a formula for determining how to arrive at the exact price range that works for your budget to get a home you love that doesn’t change your current lifestyle. No buyer wants to be stretched too thin (or be shortchanged!). Learn how to do the math so you know the monthly payment for every home you see out there. Week 5: Where to Find Money for Your Down Payment – Learn all the secret ways to get more bang for your down-payment buck. If you’re a first-time homebuyer, I want to make sure you aren’t putting every dollar you have into being a homeowner. You’ll figure out what the “right” down payment amount is for your goals and budget, and learn how to find cash if you don’t have enough funds in your personal savings. Week 6: Five Steps to Obtaining a Mortgage — Have you ever tried to make sense of all the mortgage options available out there? It’s definitely not “one-size-fits-all” these days. You’ll get a rundown of the various mortgage options out there and also the low down on private mortgage insurance (PMI) and why you may need it (and why it’s not all that bad!). Once you’re pre-approved for a loan, you’re ready to seriously start looking at homes. Week 7: It’s the Fun “House Hunting” Guide — House hunting can be fun, but it also can be overwhelming and stressful at times. Find out the ways you can shop productively (and strategically!) with tactics that will streamline your search. You’ll know what to look for and what to stay away from, the pros and cons of condos and townhomes, and the real deal with “as is” homes. Week 8: Make a Winning Offer Without Going Overboard – You’ve found a home you love and want to buy, but what’s next? No worries since we’ve got all the steps covered: figuring out your offer price, determining your earnest money deposit, some clever negotiation tactics, and even how to compete with multiple offers. Week 9: Under Contract: Locking in Your Mortgage and Getting a Home Appraisal — Did you know that you have to wait until after you are under contract until you can lock in your interest rate? (See, you are already learning something!) Here’s how to work with your lender so you avoid any possible fluctuations and more money out of your pocket. Plus, the bank loaning your money requires you to get the home appraised at this time, and here’s the scoop on that. Week 10: How to Navigate a Home Inspection — You don’t want any surprises after you move in, right?! Both old and new homes should be inspected. Here’s the breakdown of what to expect during your home inspection, the most important parts of an examination, and also what to do if any red flags arise. Week 11: Review those Condo Docs! — This step happens AFTER you are under contract. Seems backwards, but that’s how the process works. You’ll only have a few days to read sometimes hundreds of pages of documents so this handy guide will help prepare you. Purchasing a condo unit is like buying into a business, so you need to how financially sound the entire condo community is before you finalized your contract. Week 12: Almost There … Pre-Closing Details for Buyers –You have a few more details to handle before the big day and here’s a breakdown of what’s next on your list, such as obtaining hazard insurance and a home warranty (and why), and when/how to connect utilities for your new home. You want to be prepared and ready to ensure a smooth transition to becoming the owner of this home. Week 13: How to Make Your Settlement a Success — You’ve finally made it! But, there are still lots of items to cross off your to-do list, including your walk-through, getting title insurance, and your closing costs. This handy list will make sure you’re prepared and ready for this eventful day, so that it ends with your new home’s keys in your hand. Week 14 BONUS: Maintaining Your New Home – Here’s all you need to know as a new homeowner. When you walk through that front door, your life changes and you’re now responsible for everything (not a landlord!) Paying the electric bill, keeping home and repair documents organized, understanding how your home works (furnace, water heater) and making sure you schedule in regular maintenance and upkeep (HVAC and more) throughout the year. I hope you enjoy this weekly series and learn a lot. Know that each buyer has unique circumstances and I’d love to talk to you about yours. Together, we can put together a plan for how to make your first home a reality. Be sure to email me at least two to three months before you’d want to start looking for a home so we can get all your ducks in a row well before we start seeing homes!

Read More

Buying a Home with Others

You love hanging out with certain friends or have the perfect roommate in your current rental. You’ve got a great relationship with one of your siblings who lives nearby. You and your partner have been together for years and want something more permanent. Should you buy a home with them? It’s not uncommon for family members or unmarried, unrelated people to purchase a home together as either an investment property, a vacation home, or as a way to afford a more expensive house or condo in a certain neighborhood. However, there are some key points to consider before making this type of financial decision: Choose Your Co-owner(s) Carefully. This is the most important step before you go any further since you want to make sure your co-owner(s) is financially sound, has a good credit history for mortgage requirements, no outstanding liens, has life insurance, and is overall a trustworthy, responsible person when it comes to finances, bill paying, etc. Just because he’s a good buddy from work doesn’t mean you should buy a home with him. Of course, you also want to have someone you like and will enjoy living with on a daily basis if it’s a home you will share together. Create an Ownership Agreement. You may get along and think alike in many ways, but it’s important to get everything in writing. It’s like a pre-nuptial agreement but for homeownership! It’s worth the expense upfront to get a good attorney now who can help you write up a detailed agreement and who can go over the pros and cons for your particular situation and finances. You want to make sure you are on the same page on how you will own the home; how ongoing expenses such as utilities, mortgage, property taxes, homeowners insurance will be divided up and paid; and how an owner’s share will get transferred when necessary. What about renting out your share if you move and don’t want to sell? Who gets the tax deduction since unrelated people can’t file a joint tax return? There are lots of things to consider when writing up this agreement. Work this all out with your co-owner(s) now when everyone is calm and willing to discuss. You might also want to add a clause to your ownership agreement in which a third party mediator would be brought in to handle any future disputes that can’t be resolved easily. You’ll be happy you have this document since it will prevent misunderstandings (and possible court proceedings) later on and will help you settle a situation when something does arise. Decide on Ownership Title. First and foremost, the co-owners need to agree on how the property’s title will be held, which is basically the type of joint ownership: Tenants in Common (TIC) – Most friends or unrelated owners choose this type of ownership so that each co-owner has a separate legal title. The shares in a TIC can be equal or unequal percentages depending on how much someone will be contributing toward the home. In this arrangement there is no right of survivorship, so each co-owner can pass along his or her share via will to others outside the ownership agreement. However, the co-owners can make an arrangement to have “right of first refusal” so that the remaining owners can decide if they want to buy out the other owner or his/her heirs if that’s the case. Joint Tenants with Right of Survivorship (JTWROS) – Most married couples have this form of joint ownership, so if one spouse dies, the survivor automatically becomes the sole owner. Some family members or unmarried couples buying together also may choose this type of arrangement and share one title between the co-owners so that the home stays in the “family”. Limited Liability Company (LLC) – Some co-owners decide to create an LLC or a trust to hold the property’s title. This makes moving owners on and off the title easier. Again, work with your attorney to determine what would be the best type of ownership for your situation and finances. Create a Co-habitation Agreement. This is another document that you should get in writing with details on everything, and I mean EVERYTHING, that may come up – how to divide responsibilities for home maintenance and repair; who buys furniture and appliances; who gets access to the home and when (especially important for vacation homes); rules for pets, smoking, visitors, overnight guests, future boyfriends or girlfriends moving in, big parties, groceries, etc. etc. You’ve probably lived with roommates at some point in your life or at college, so you know what daily habits can make or break any harmony in a living situation. Anticipate what can come up and discuss with your co-owner(s) now to set up some ground rules. Since you own a home with them, you just can’t walk away with little notice but need to be responsible and compatible in order to make your ownership agreement work. However, no matter how great things may be going, you are going to need an exit plan… Create an Exit Plan. You can’t plan life when it comes to joint ownership – getting married, new job in another city, a change in finances – but you can be prepared. We’ve already discussed above how different types of joint ownership can affect how one owner can transfer shares to another or not. This is where “right of first refusal” comes into play. But how will you agree on a sales price – get two appraisers and average their findings? What if you’re a domestic couple not married and no longer want to own a home together? As you can see, it can get complicated and that is why you should work with your attorney and include a detailed exit plan in your Ownership Agreement. Together all co-owners should come up with a fair, agreeable plan now so that you can begin AND end on good terms. Buying a home with others – either friends, family members or a partner – can be a wonderful experience but just remember to plan carefully since you will be dealing with them financially over the long term. But, there are details that need to be worked out before moving forward. If you are thinking of going this route, let’s talk well before you are ready to start looking at houses. Email me and we can schedule a time to talk through what you need to know.

Read More

How An Appraisal Can Make or Break a Sale

No home sale is every final until you get to settlement. That is a fact and explains why real estate signs say “Contract Pending” before being replaced with “Sold.” There’s a lot that goes on after a buyer’s offer is accepted by the seller. And a key factor in getting to closing day is the home appraisal by the lender. When the appraised value of a home comes in below the contract price, it could cause the sale to fall through. No new home for the buyer and no final sale for the seller. This does happen even in the DC metro area despite the bidding wars over homes. Sometimes the price gets pushed up more than what the recent sales would suggest is the value of the home. What can you — as a buyer or seller — do to prevent a low appraisal or, in the event of a low appraisal despite doing everything right, still have the sale go through? Read the strategies and insights below and prepare for one of the most important yet overlooked part of a home sale—the appraisal. Home Appraisal 101 First, let’s discuss the basics of the appraisal process—what it is and why it’s a necessary step as part of a purchase. A bank needs to make sure that the money they are lending for a home is for a home that is habitable, exists and also that they are not lending more than the value of a home in case of the worst case scenario, which is foreclosure. To that end, the bank will hire a licensed appraiser to visit the home and do two things. One, the appraiser needs to make sure the home is habitable and two, the appraiser tours the home to make notes about how it compares with the other homes that have recently sold nearby. These homes are called comparable or “comps” for short. Then, the appraiser will look at the comparables (sales over the last six months) to help determine the current value of the home that someone is buying. The valuation is also based on market trends, supply and demand, time on market, and takes in consideration any extenuating factors such as upgrades or something like being on a higher floor or end unit. Since it’s never an “apple-to-apple” comparison, the appraiser will make adjustments to the appraisal for some features of a home — a finished basement, a coveted view, updated appliances or HVAC systems. Remember, however, some improvements don’t add as much value as you would like … such as a new half bath, landscaping, etc. For a condo unit, an appraiser will consider the number of units in the condominium community, how many are on the market and how many were sold. The most weight is given to homes that have sold in the same building since buildings are so different, even in the same neighborhood. Appraisal Law Changes Process The appraisal process went through a change a few years back when the Home Valuation Code of Conduct was passed. This law was meant to make appraisers more independent and not “hired” by the real estate agents, buyer, seller, or bank handling the transaction. But in some cases, appraises may not be local to the area where they were appraising homes, especially when appraisal management companies are involved. There’s been some questioning of how well these appraisers know the neighborhoods and the “true” value of a home when an appraisal comes in too low. What a Buyer Can Do If you’ve found a home you love but the appraisal comes in too low, you’ll need to consider several options. Should you still purchase the home if the value is lower? Do you think the appraisal is not accurate in the current demand or the market? It’s good to have a strategy in place. Remember, the seller wants to sell their home. Even though they would love the higher contract price, they may have to renegotiate with you but most likely will appeal the low appraisal as a first course of action. If you think the appraisal is flawed, you can challenge the appraisal. As a buyer, you now have the right to receive a copy of appraisals and computer valuations and other data. Switch lenders to start over again with a new appraiser. Save more money so you have more leeway in putting more down or making up the difference on a low appraisal if you truly want the home and there are other buyers in line to snap it up. Work with the buyer to see if they will lower the price or help pay for some of the closing costs or any other costs. Make sure your offer included an appraisal contingency so that you do have the option to exit the sale if it the value of the home is lower than the contract price. However, having this contingency may weaken your initial offer if it’s a competitive market. What a Seller Can Do If an appraisal comes in lower than the contract price, it may mean the end of the sale with this particular buyer. However, there are steps you can take to help avoid this and to also move the sale along. It might be worth the time to work with this buyer rather than start all over again, but you just might have to do that if many of these actions below don’t work. 1) Provide details on any home improvements to the appraiser so nothing is missed. Your agent can contact the lender so they can connect with the appraiser who is hired to evaluate your home. 2) Ask to review the appraisal to see if any adjustments were made, especially if you submitted information to the appraiser. A lender has to comply with the request within 30 days. 3) Appeal the appraisal for a reconsideration of the value of the home. Provide the comparables you and your agent think represent the home’s value better and why. You will need to show any discrepancies between the appraisal and any improvements or unique features of the home. 4) Ask for another appraisal, but you would have to pay for it. However, if it’s an FHA loan, an appraisal stays with that home for 6 months so you can’t ask to switch lenders or get a new appraisal. 5) Ask the buyers if they are willing or able to pay for the higher contract price and make up the difference themselves. Some buyers may be willing or able to make a larger down payment. If it’s a tight market, the buyers may feel the pressure to pay since there could be another buyer in line who is able and willing. 6) Renegotiate with the buyer and to offer a lower price or pay for closings costs. If you don’t have any other potential buyers, you may need to make such accommodations so that the sale does go through. 7) If you’ve got an all cash buyer in the mix, you won’t have to deal with a bank or appraisals at all. That’s a big plus as a seller. As you can see, a lot goes on “behind the scenes” during the appraisal. The good news is that both buyers and sellers have options to continue the sale if the appraisal comes in too. This part of the home buying process can feel mysterious and overwhelming, but that’s what I’m here for! Email Me and we can talk more about it so you understand things fully. It’s never too early to start! Plus, understanding the process makes moving forward a whole lot less nerve-racking once you are ready. I’m looking forward to hearing from you and helping you.

Read More

How to Answer “What Neighborhood Should I Live In?”

Where you live affects everything about your lifestyle. Every. Single. Day. Read the above statement again and let it sink in. Why? Because finding a location that matches your wants and needs is so critical to your happiness in your home and in your daily life. Think about this … you can always change or alter something you don’t like about a particular home. You can paint over some god-awful color in the bedroom, upgrade a kitchen with new stainless appliances, or even budget for large family room addition. What you can’t do is change the location! No matter how much you may love everything about your new home, if you are frustrated with your neighborhood or it doesn’t fit with who you are or who you want to be, then you aren’t going to be satisfied … ever. Keep in mind that you could find a similar neighborhood with the same feel and conveniences of a favorite neighborhood, and it could be more in line with your price range. That is why not limiting yourself and doing research on all sorts of neighborhoods is worth your time before you start house hunting. There could be a hidden gem just for you! First we will cover how you can learn more about neighborhoods and provide some research tips. Then we will give you some guidance on how you can figure out what characteristics you most want in a neighborhood or location. Your list of “wants, needs & musts” is what should drive your search for a home and compatible neighborhoods. Neighborhood Research 101 If you’re ready to buy a home, then schedule some time now to gather as much information you can on different neighborhoods. Don’t cancel out certain areas since you might be surprised how compatible they are to your lifestyle and budget. Do Some Foot Work Even though the internet can give you lots of information, it’s still good to do some research on foot and face-to-face. Ask friends, family or colleagues about neighborhoods they like, have heard about or even live in. Talk to people who live the different neighborhoods you are considering. What do they like? Think about their answers and how is their life or daily habits compared to yours? There are lots of choices and new communities all over so be adventurous and use these personal contacts! Plan to visit friends, family, colleagues and see their neighborhoods in person. Meet them for lunch or dinner, walk around, visit stores. You’ll get a better feel for the atmosphere and amenities of the area. You should get honest and direct answers about schools, crime, traffic, parking etc. Drive around both day and night, rush hour and weekends, and as much as possible to see how the neighborhood works and functions on a daily basis. Find out from your contacts if their neighborhood has a good community listserv or e-newsletter and sign up! Whether it is via email, Facebook, Twitter, Instagram or however they may keep neighbors updated, you’ll be able to monitor posts. These can give you a more inside look at a particular location – events, activities, a sense of the community feel, and any ongoing concerns by neighbors. Let Your Fingers Do the Walking The internet makes it very easy and convenient to get information on different neighborhoods. These two sites give a great overview of metro neighborhoods: https://www.washingtonian.com/location/ https://washington.org/dc-neighborhoods Look into the neighborhood BID (Business Improvement District). Many of them have weekly e-newsletters. A BID provides addresses cleanliness, maintenance, safety, promotion, and economic development of certain neighborhoods. Adams Morgan Partnership BID Capitol Hill BID Capitol Riverfront BID Downtown DC BID Dupont Circle BID Georgetown BID Mount Vernon Triangle BID NoMa BID Anacostia BID Ballston BID Golden Triangle BID Southwest BID Why Neighborhoods Matter It’s the little daily habits that can make a big difference in where you live. A certain neighborhood may or may not match what you love to do every day or even need to do every day. Why frustrate yourself from the get-go? Determine what you like most about your day. Really consider what you do and don’t like about your current neighborhood. Write it ALL down. Keeping asking and answering questions such as these: Do you love being able to walk or bike to work? Do you love going to your local coffee house every day? Do you like to go for runs outside? Do you need to walk your dog or live near a dog park? Do you want to be near work and have a short commute? Do you love to be near restaurants, theaters, or close to more vibrant hot spots? Do you hate crowds, busy streets and traffic? How important is a car and/or parking space to you? Do you want a car-free life where you can walk, metro or bike everywhere? Or you can’t imagine your life without a car. Is community important to you or schools, recreation centers or park space? Do you feel the need for green space, grass, trees and lots of open space? Do you love to garden or want a large backyard for children or dogs? Or is a playground or dog park nearby sufficient? Same Vibe, Different Neighborhood Once you determine what you like most about certain neighborhoods, you can then pinpoint which neighborhoods meet these “needs, wants & musts.” And, if prices don’t match your budget, then you can still find the same “neighborly” vibe but for less cost in another location. If your “must” is being able to walk to work or be near mass transit, then everything else could change (the home’s size, condition, etc.). Your budget will determine what type of home you can afford in a particular neighborhood – such as a detached home, townhome or condo unit. You can always tweak your budget or rethink some of your “musts” if you’re way off base and can’t even find a comparable neighborhood. Don’t Forget About Resale There are certain factors in a location – both desirable and undesirable — that you should consider for resale value. Does the neighborhood have good schools? Is the home on a busy corner lot? Crime and traffic can affect a home’s value. Also, keep in mind that revitalizing neighborhoods can be on your list if more popular and expensive neighborhoods are out of your price range. An up and coming neighborhood could be a bargain if you time it right, but do your research and be confident it’s heading upwards. As you can see, do your research! You’ll be more satisfied with your purchase if you know about different neighborhoods. They’ll be no “what ifs” or “should haves” that will haunt you in your new home. If you are having a hard time deciding which neighborhood or neighborhoods you want to live in, I can help with that! Don’t feel like you have to have everything figured out before you reach out! My job is to help you along the way, even before you are ready to buy. I may even be able to connect with clients that live in the neighborhoods you are considering to give you the inside scoop! I can’t wait to hear from you. Just email me and we can schedule a time to talk more.

Read More

Categories

Recent Posts

REALTOR® Lic# SP200205008|5005063|0225251751

REALTOR® Lic# SP200205008|5005063|0225251751I am committed to helping you find your dream home, selling your property for the best possible price, and providing top-notch real estate services. I am dedicated to providing personalized attention and expert guidance to meet all of your real estate needs. Whether you are a first-time homebuyer or an experienced investor, I am here to help you navigate the complex and ever-changing real estate market. I pride myself on local knowledge, professionalism, and commitment to exceeding your expectations. Explore my website to learn more about the services I provide and the properties I have to offer. Contact me today to start your real estate journey

+1(202) 494-0110 lorin@homeswithmones.com1017 O St NW Washington, DC, 20001

https://homeswithmones.com