What You MUST Do When You Go Under Contract

Love Buying a Home series – Week 9 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure

Read More

Make a Winning Offer Without Going Overboard

Love Buying a Home series – Week 8 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure

Read More

It’s the Fun “House Hunting” Guide

Love Buying a Home series – Week 7 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure

Read More

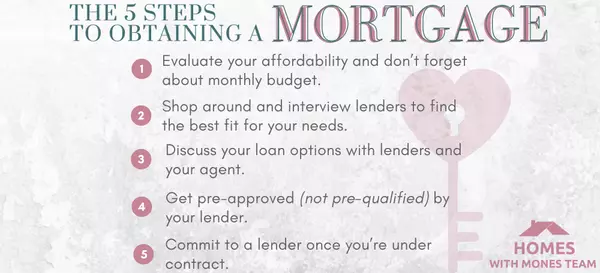

5 Steps to Obtaining a Mortgage

Love Buying a Home series – Week 6 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure t

Read More

Categories

Recent Posts

REALTOR® Lic# SP200205008|5005063|0225251751

REALTOR® Lic# SP200205008|5005063|0225251751I am committed to helping you find your dream home, selling your property for the best possible price, and providing top-notch real estate services. I am dedicated to providing personalized attention and expert guidance to meet all of your real estate needs. Whether you are a first-time homebuyer or an experienced investor, I am here to help you navigate the complex and ever-changing real estate market. I pride myself on local knowledge, professionalism, and commitment to exceeding your expectations. Explore my website to learn more about the services I provide and the properties I have to offer. Contact me today to start your real estate journey

+1(202) 494-0110 lorin@homeswithmones.com1017 O St NW Washington, DC, 20001

https://homeswithmones.com